Credit Cards in Germany 🇩🇪

Germany is internationally known for being one of the few developed countries that still primarily uses

cash for the vast majority of daily payments.

As you may anticipate, credit card usage is not prevalent, even with several available options.

However, these options seldom provide the extensive benefits found in other countries.

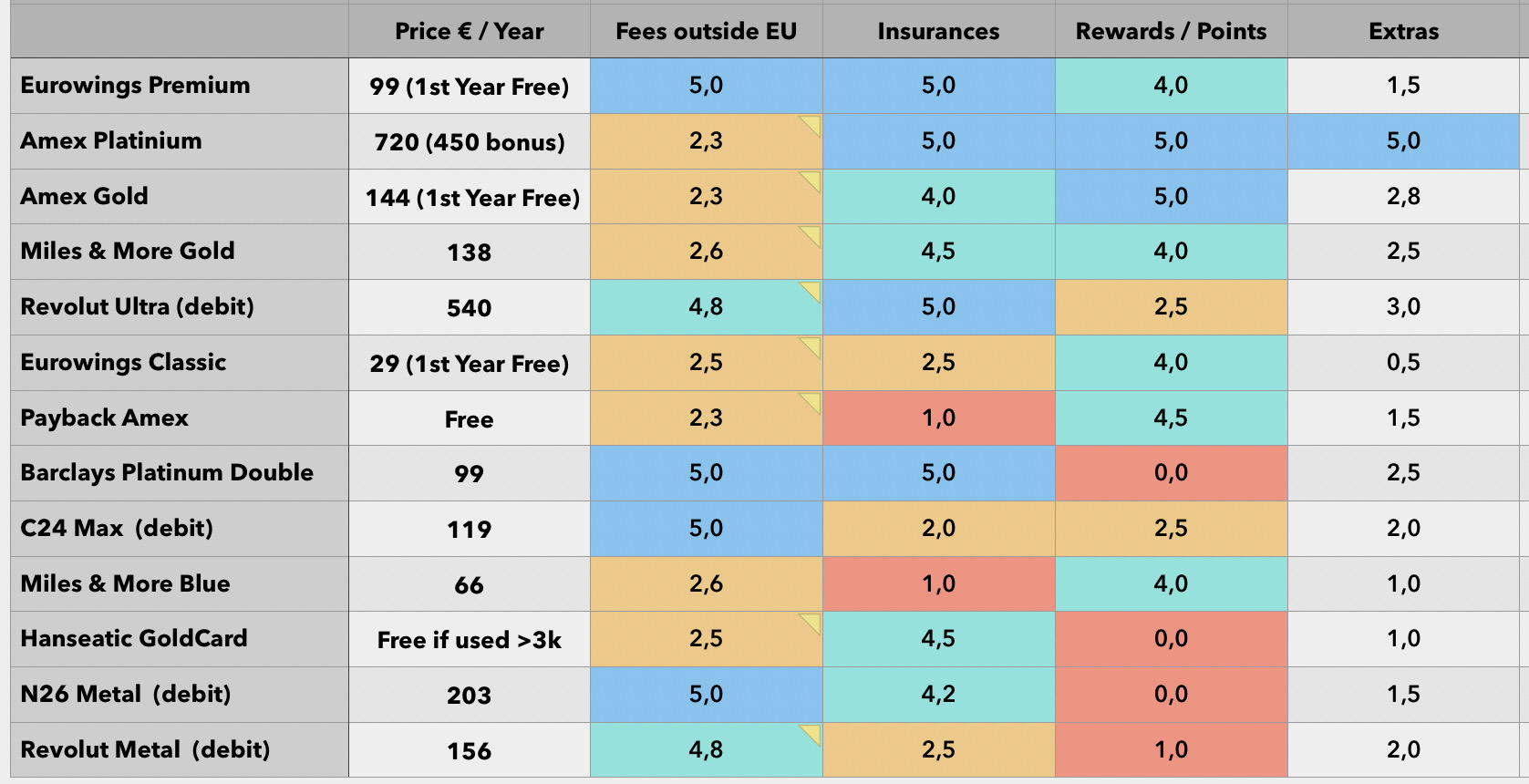

Following several weeks of research on this topic, the above table was compiled as a comprehensive visual reference, solely derived from my travel-focused criteria.

Important criteria for credit card evaluation:

- Miles / Points Program (or cashback)

- Included travel insurances: Flight cancellation, flight delay, lost baggage, trip cancellation due to illness, coverage for car rentals.

- Annual fee

- Foreign currency usage fee

- Additional benefits

Pertinent considerations about Amex cards:

- The acceptance of Amex in Germany is notably limited, and its prevalence is slightly higher in other European nations; nevertheless, it remains considerably behind Visa and Mastercard.

- Having only an Amex card is not viable; having a second card is mandatory.

- The Platinum card undeniably stands as the premier option, and it offers the opportunity to secure promotions with Welcome Bonuses that essentially offset the expense of an intercontinental journey.

- The Platinum card's annual fee can be intimidating at first, but there are many benefits and "cash" bonuses that virtually reduce the annual fee's value if you actually use most of the bonuses.

- If you prefer a different Amex card, the Gold card has good cost-effectiveness. Alternatively, the American Express Card, also known as Green, is cheaper than the Gold, with slightly less travel insurance coverage.

I highly recommend everyone to have at least the

Amex Payback card,

which is free.

I highly recommend everyone to have at least the

Amex Payback card,

which is free.

Combining all the possible Payback bonuses with the annual bonus transfer, plus the Amex Max package that doubles the points for every 2 EUR spent, this card is the best option for accumulating points that turn into Miles & More miles. [reference link]-

Activate Amex Turbo/Max, an additional paid feature that increases the number of points earned for every 2 EUR spent,

significantly improving your points accumulation.

Check the current cost for activating this feature on the American Express website, at least for the Amex Payback card, the cost was 30 EUR per year.

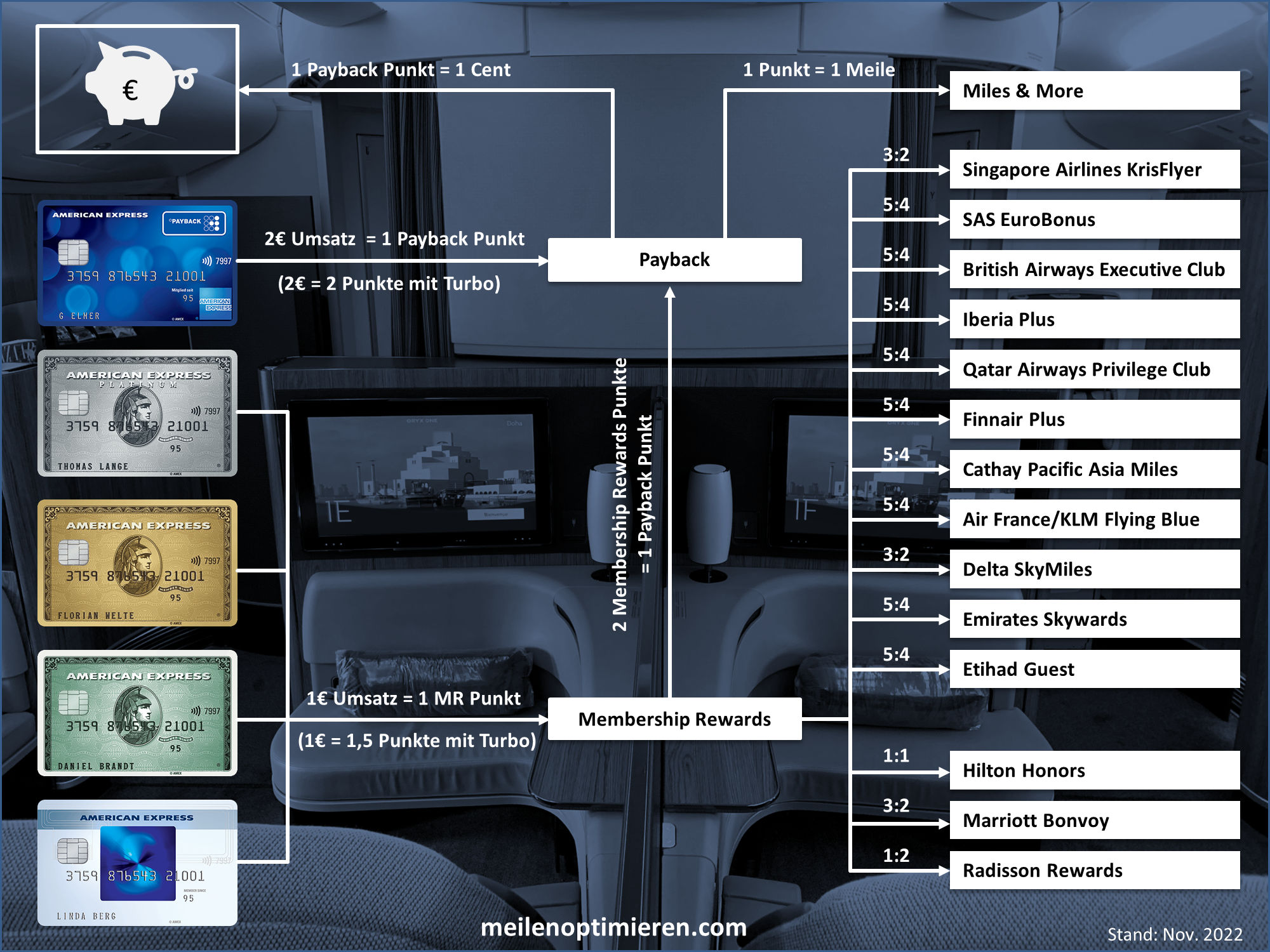

The Membership Rewards® program is the foremost advantage and a distinguishing feature that sets American Express

apart from any other Visa or Mastercard offering. That's why it comes with a price.

This program offers direct point transfers from Amex to various loyalty programs and hotel networks. There's no other similar

option available in Europe.

Having this flexibility is crucial for any traveler who wants to choose the best deals and routes, regardless of the airline

and loyalty program.

You can initiate a request for any of the Amex cards using our [referral link].

If you're considering signing up for any other Amex card besides Payback, DO NOT apply for Payback first!

You need to wait 18 months to be eligible for Welcome Bonuses if you already have an Amex card.

What other cards are worth considering?

As you can see in the above rating table, the

Eurowings Premium card

received the highest score in each analyzed category.

As you can see in the above rating table, the

Eurowings Premium card

received the highest score in each analyzed category.

It generates Miles & More miles, valid for 36 months, has excellent insurance coverage, on par with the Amex Platinum, has no extra fees for foreign currency usage, and offers a few extra benefits if you ever use Eurowings. The card is issued by Barclays bank, and it's flexible regarding early payments and even interest-free installment options.

If a slightly less comprehensive insurance package suits you, the Eurowings Classic is the best option for generating Miles & More miles, with some additional minor benefits. It's cheaper than the Miles & More Card but has the downside of miles expiring every 36 months.

Payback Card

Regardless of the credit card you'll apply for in the future, as recommended above, having a Payback card is truly essential

in Germany,

I would even say it's essential in any country where Payback operates.

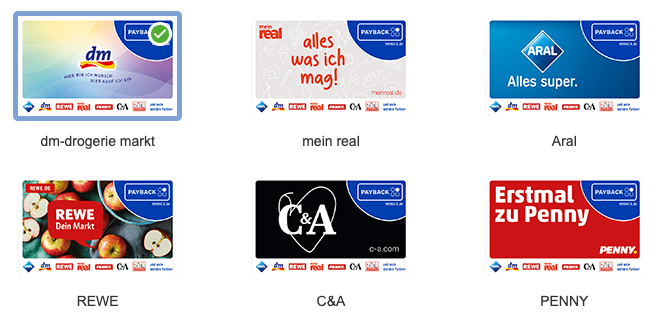

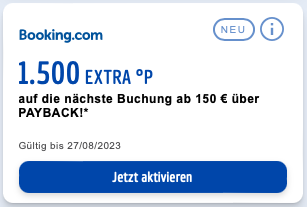

Payback has more than 600 partner stores, making it one of the largest points (and discounts) programs in Europe.

Payback points can be converted to Miles & More miles at a 1:1 ratio. One of the greatest Payback benefits is the coupons that multiply points earned in each purchase. Since you'll probably use grocery stores, pharmacies, DM, and other affiliated stores and websites like Amazon, not having at least a points card means missing out on accumulating miles "for free".

Effectively, the most efficient way to accumulate Miles & More miles in Germany is by using:

Payback + Amex Payback Card with Turbo/Max function activated and making the bonus transfers offered by Payback

(do not confuse with automatic transfers that should NOT be used).

Effectively, the most efficient way to accumulate Miles & More miles in Germany is by using:

Payback + Amex Payback Card with Turbo/Max function activated and making the bonus transfers offered by Payback

(do not confuse with automatic transfers that should NOT be used).

This setup is mathematically unbeatable. The downside is that you'll need a second Visa or Mastercard card,

mainly for travel insurance benefits and to earn points where Amex cards are not accepted.

Payback has two types of cards available in Germany:

- Co-branded Cards: Loyalty cards, only for accumulating points and not used for payments. You can request a Payback card and choose from over 30 Payback partners to be the issuer of your card. Among them, DM, C&A, and Rewe. They work exactly the same; only the card's design differs. Use the [referral link] to request yours.

- Credit Card: Card issued by American Express, free, without an annual fee, that accumulates Payback points even in non-participating stores. Use the [referral link] to apply for yours.

Payback usage tips

-

If you're planning to apply for an Amex Payback card, keep in mind that It's imperative to observe an 18-month interval

before applying for any other Amex card to be eligible for a full Welcome Bonuses.

If you're considering any other Amex card but are still unsure, it's better to wait a bit and not "waste" your Welcome

Bonus opportunity by applying for Payback too recently.

If you're planning to apply for an Amex Payback card, keep in mind that It's imperative to observe an 18-month interval

before applying for any other Amex card to be eligible for a full Welcome Bonuses.

If you're considering any other Amex card but are still unsure, it's better to wait a bit and not "waste" your Welcome

Bonus opportunity by applying for Payback too recently.

- The coupons available in the app are almost always personalized and may vary between accounts, so it's common to have coupons in your account that aren't available in others you compare.

- Have separate accounts for you and your partner and even for children. Since the coupons are individual, having separate accounts will give you a wider variety of available coupons and promotions.

- Centralize point transfers in a single Miles & More account. If you have separate accounts for your family members, the points can be transferred to any Miles & More account, even if the number is provided and doesn't need to be in the same name as the Payback account holder.

- DO NOT activate automatic transfers to Miles & More; wait for the bonus transfer promotions that happen at the end of the year and sometimes in the middle of the year as well.

- You can combine subscription service coupons with card benefits like Amex Platinum, which offer refunds for these services up to a certain limit. (check the conditions with Amex before purchasing the coupons)

- Some large 20x, 30x coupons are available in the Rewe and DM apps directly. Also, keep an eye out for "gift card" coupons from stores you might use in the near future, like Adidas, Apple, Amazon, Aral, etc., which usually offer substantial bonuses.

- Remember to accept the use of cookies when shopping online using links within the Payback website.

- Extra points earned by booking hotels on Booking.com are usually credited only between 40 and 60 days after the checkout date. Be patient to avoid thinking you lost your points.